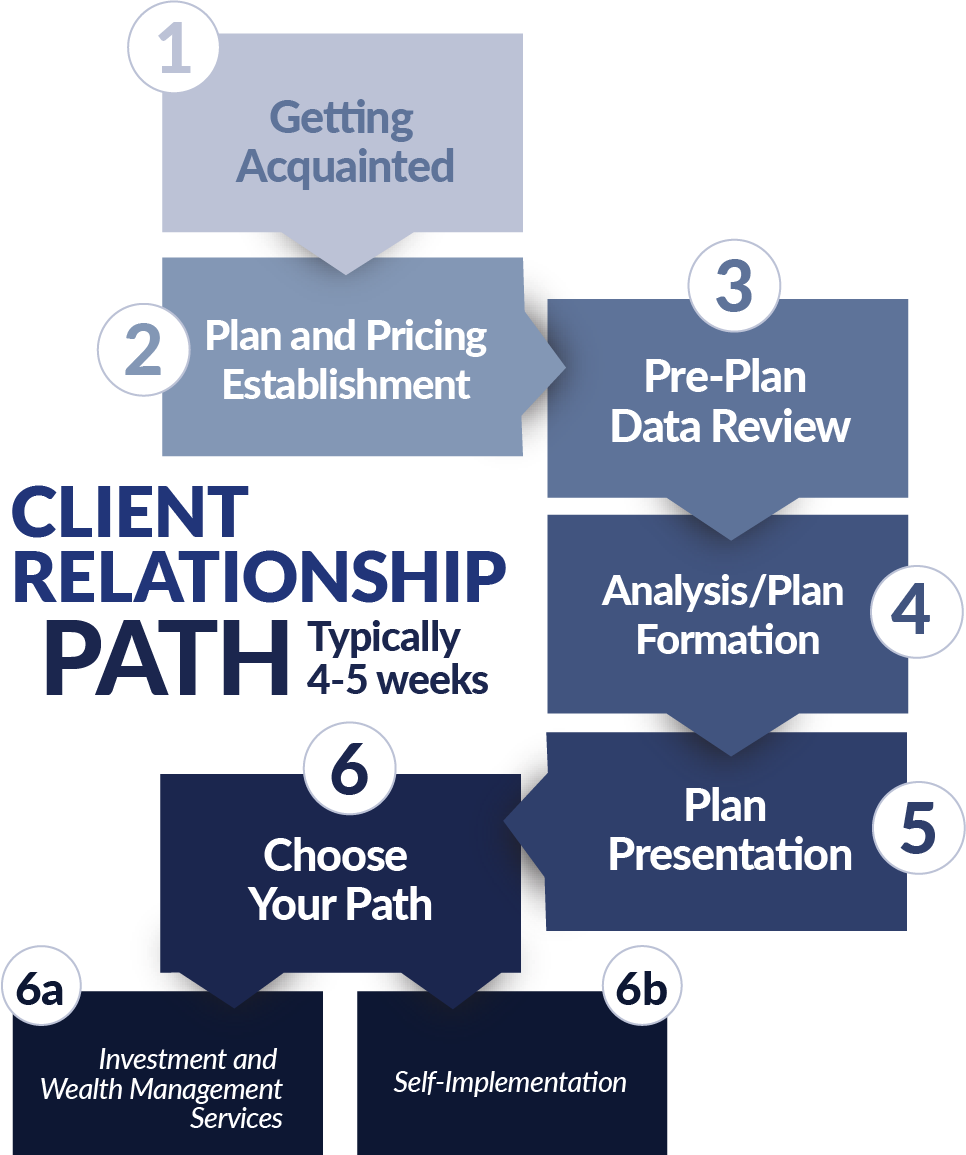

Step 1

Get Acquainted

Our Responsibilities

We will meet with you free of charge in person or via teleconference. This is an opportunity to exchange information about your needs and objectives and to discuss further which of our services is right for you. MJTa will briefly describe our services, philosophies, methodology, and fee structure.

Your Responsibilities

If our services fit your needs, we request you complete our Confidential Client Questionnaire.

Step 2

Plan and Pricing Establishment

Our Responsibilities

After we receive your Confidential Client Questionnaire data, complexity, and goals, MJTa will establish final pricing and communicate with you. We will send you clear pricing information, the financial plan's objectives, and the financial planning engagement agreement.

Your Responsibilities

If you proceed with our services and fee, you will sign and return the financial planning agreement.

Step 3

Pre-Plan Data Review

Our Responsibilities

After engaging our services and receiving your financial information, we will begin to review and develop your custom plan. We will prepare an initial plan and formulate any follow-up and clarification questions.

Your Responsibilities

We will set up a call to review questions and send you our Risk Tolerance Questionnaire to complete.

Step 4

Analysis/Plan Formation

Our Responsibilities

We will refine the reports based on the information you provided and study various plan scenarios. We will provide analysis and research based on our findings and prepare the final reports that include observations, assumptions, specific recommendations, and an action plan for your unique situation.

Your Responsibilities

The ball is in our court. All you have to do now is wait for your Plan Presentation meeting.

Step 5

Plan Presentation

Our Responsibilities

We will meet to review your financial planning report, present our personalized recommendations, and discuss any questions you may have. You now hold your custom blueprint for financial success designed with your goals in mind. You are empowered with specific recommendations to implement your financial plan.

Your Responsibilities

If you wish, you may employ MJTa to further assist you in carrying out your Investment and Wealth Management Services.

Step 6

Choose Your Path

a. Investment and Wealth Management Services

After completing the initial financial planning project, clients can continue the relationship by engaging MJTa for ongoing Investment & Wealth Management services. With this service level, we do the heavy lifting by assisting in implementing many of the personalized recommendations from start to finish. This includes helping with account transfers and rollovers, placing trades, developing an investment policy statement, and daily cash monitoring. When working with our clients in an ongoing capacity, we can help them proactively strategize and optimize in a team effort to accomplish their important financial goals while also helping them avoid costly missteps.

b. Self-Implementation

If clients choose to implement the recommendations themselves, their engagement with MJTa will end after the presentation.